Tax Advantages for RV Campgrounds

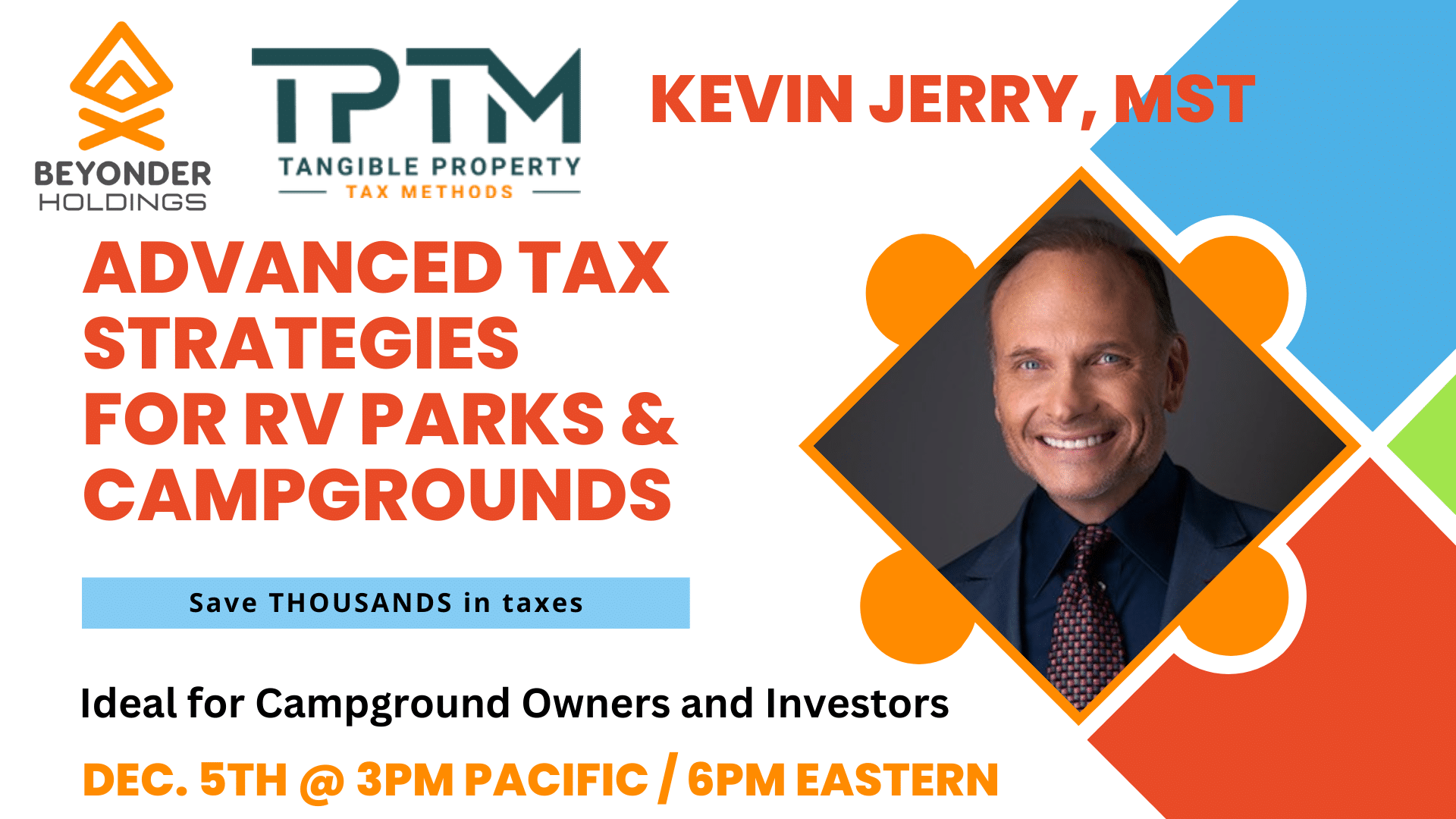

Beyonder is pleased to present a one-hour webinar with Kevin Jerry, MST, one of the nation’s leading authorities on Cost Segregation, the mandatory Tangible Property Regulations, partial asset dispositions and revenue recognition changes. Kevin graduated Cum Laude from the University of Cincinnati with a Master of Science Degree in Real Estate Taxation.

Over the last ten years, he has worked with Eric Wallace on the Tangible Property Regulations with some of the largest property owners in the country. He is a sought-after speaker on the Tangible Property Regulations, the Real Estate Professional certification, and the nuances of Cost Segregation.

Kevin has recently spoken at such venues as the American Institute of Certified Public Accountants, the Maryland CPA Association, the Florida CPA Association, the Hong Kong Trade Association, the California CPA Association and The National Center for Tax Strategies.

Come spend some quality time with us on learning about the tax advantages of Cost Segregation. What it is, how it works, and how it can save you thousands on your taxes?

Register for the live webinar HERE

Build wealth and save on taxes with Beyonder!